Men in dusty workwear trudge through a thicket, making their way up a hill where sprawling plantations lay tucked in a Nigerian rainforest whose trees have been hacked away to make room for cocoa bound for places like Europe and the U.S.

Kehinde Kumayon and his assistant clear low bushes that compete for sunlight with their cocoa trees, which have replaced the lush and dense natural foliage. The farmers swing their machetes, careful to avoid the ripening yellow pods containing beans that will help create chocolate, the treat shoppers are snapping up for Christmas.

Over the course of two visits and several days, The Associated Press repeatedly documented farmers harvesting cocoa beans where that work is banned in conservation areas of Omo Forest Reserve, a protected tropical rainforest 135 kilometers (84 miles) northeast of the coastal city of Lagos in southwestern Nigeria.

Trees here rustle as dwindling herds of critically endangered African forest elephants rumble through. Threatened pangolins, known as armored anteaters, scramble along branches. White-throated monkeys, once thought to be extinct, leap from one tree to the next. Omo also is believed to have the highest concentration of butterflies in Africa and is one of the continent’s largest and oldest UNESCO Biosphere Reserves.

Cocoa from the conservation zone is purchased by some of the world’s largest cocoa traders, according to company and trade documents and AP interviews with more than 20 farmers, five licensed buying agents and two brokers all operating within the reserve.

They say those traders include Singapore-based food supplier Olam Group and Nigeria’s Starlink Global and Ideal Limited, the latter of which acknowledged using cocoa supplies from the forest. A fewer number of those working in the forest also mentioned Tulip Cocoa Processing Ltd., a subsidiary of Dutch cocoa trader and producer Theobroma.

Those companies supply Nigerian cocoa to some of the world’s largest chocolate manufacturers including Mars Inc. and Ferrero, but because the chocolate supply chain is so complex and opaque, it’s not clear if cocoa from deforested parts of Omo Forest Reserve makes it into the sweets that they make, such as Snickers, M&Ms, Butterfinger and Nutella. Mars and Ferrero list farming sources on their websites that are close to or overlap with the forest but do not provide specific locations.

Government officials, rangers and the growers themselves say cocoa plantations are spreading illegally into protected areas of the reserve. Farmers say they move there because their cocoa trees in other parts of the West African country are aging and not producing as much.

“We know this is a forest reserve, but if you are hungry, you go to where there is food, and this is very fertile land,” Kumayon told the AP, acknowledging that he’s growing cocoa at an illegal plantation at the Eseke farming settlement, separated only by a muddy footpath from critical habitat for what UNESCO estimates is the remaining 100 elephants deep in the conservation zone.

Conservationists also point to the world’s increasing demand for chocolate. The global cocoa and chocolate market is expected to grow from a value of $48 billion in 2022 to nearly $68 billion by 2029, according to analysts at Fortune Business Insights.

The chocolate supply chain has long been fraught with human rights abuses, exploitative labor and environmental damage, leading to lawsuits, U.S. trade complaints and court rulings. In response, the chocolate industry has made wide-ranging pledges and campaigns to ensure they are sourcing cocoa that is traceable, sustainable and free of abuse.

Companies say they have adopted supply chain tracing from primary sources using GPS mapping and satellite technology as well as partnered with outside organizations and third-party auditors that certify farms’ compliance with sustainability standards.

But those working in the forest say checks that some companies rely on are not done, while one certifying agency, Rainforest Alliance, points to a lack of regulations and incomplete data and mapping in Nigeria.

AP followed a load of cocoa that farmers had harvested in the conservation zone to the warehouses of buying agents in the reserve and then delivered to an Olam facility outside the entrance of the forest.

Staffers at Olam’s and Tulip’s facilities just outside the reserve, who spoke on condition of anonymity because they’re not authorized to discuss their companies’ supplies, confirmed that they source cocoa from farmers in the conservation zone.

‘THEY BUY EVERYTHING’

The Omo reserve consists of a highly protected conservation zone ringed by a larger, partially protected outer region. Loggers, who are also a major source of deforestation, can get government licenses to chop down trees in the outer areas, but no licenses are given anywhere for cocoa farming. Agriculture is banned from the conservation area, except for defined areas where up to 10 indigenous communities can farm for their own food.

Nigeria is one of Africa’s biggest oil suppliers and largest economy; after petroleum, one of its top exports is cocoa. It’s the world’s fourth-largest producer of cocoa, accounting for more than 5% of global supply, according to the International Cocoa Organization. Yet it’s far behind the world’s largest producers, Ivory Coast and Ghana, which together supply more than half of the world’s demand and are often singled out in companies’ sustainability programs.

According to World Bank trade data and Nigeria’s export council, more than 60% of Nigeria’s cocoa heads to Europe and about 8% to the United States and Canada.

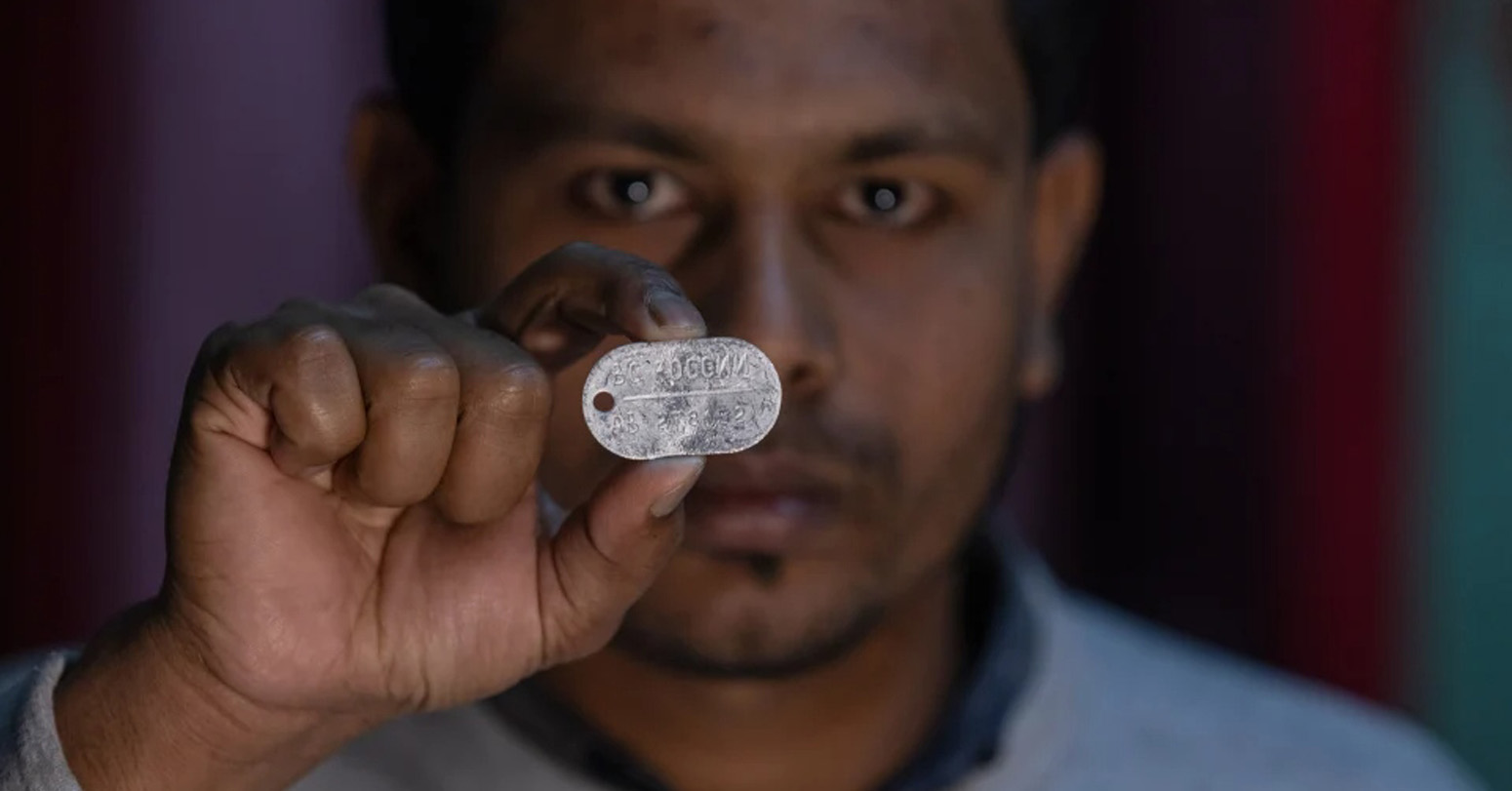

It passes through many hands to get there: Farmers grow the cocoa beans, then brokers scout farms to buy them. Licensed buying agents purchase the cocoa from brokers and sell it to big commodity trading companies like Olam and Tulip, which export it to chocolate makers.

In October, AP followed a blue- and white-striped van loaded with bags of cocoa beans along a road pitted with deep mud holes within the conservation zone to an Olam warehouse just outside the entrance of the forest. At the warehouse, which Olam confirmed was theirs, AP photographed the cocoa being unloaded from the van, whose registration number matched the one filmed in the forest.

Farmer Rasaq Kolawole and licensed buying agent Muraina Nasir followed the van to sell the cocoa, and neither expressed misgivings about the deforestation.

“We are illegal occupants of the forest,” said farmer Kolawole, a college graduate and former salesperson.

AP also visited four cocoa warehouses in the forest belonging to licensed buying agents: Kadet Agro Allied Investments Ltd., Bolnif Agro-allied Farms Nigeria Ltd., Almatem and Askmana. Managers or owners all told AP that they buy from farmers growing cocoa in protected areas of the forest and that they sell that cocoa to Olam. Three of the warehouse managers told AP that they also sell to Tulip and Starlink.

“They do not differentiate between cocoa from local — that is farms outside the forest — and the reserve,” said Waheed Azeez, proprietor of Bolnif, describing how “big buyers like Olam, Tulip and Starlink” buy cocoa sourced from deforested lands. “They buy everything, and most of the cocoa is from the reserve.”

Despite AP’s findings, Olam insists that it “forbids” members of its “Ore Agbe Ijebu” farmer group from “sourcing from protected areas and important natural ecosystems like forests.” That Ijebu farmer group is listed as a sustainable supplier on Olam’s website and is said to be in Ijebu Ife, a community near the reserve.

“Any farmers found not complying with the code and illegally encroaching on forest boundaries are removed from our supply chain and expelled from the OAIJ farmer group,” the company said in a statement emailed to AP.

However, Askmana manager Sunday Awoke said, “Olam does not know the farmers. We buy from the farmers and sell directly to Olam, and no assessment against deforestation takes place.”

Speaking to AP as a convoy of motorcycles brought bags of cocoa from the conservation area to his warehouse within the reserve, Awoke said he used to be a conservation worker who fought deforestation by farmers.

“But I am on the other side now. I wish to go back, but survival first, and this pays more,” he said.

Others agreed.

“The place is not meant for cocoa farming, but elephants,” said Ewulola Bolarinwa, who is both a broker and a leader of those who farm at the Eseke settlement inside the conservation zone. “We have a lot of big buyers who supply the companies in the West, including Olam, Tulip and many more.”

COCOA TO CHOCOLATE

Ferrero, which makes Ferrero Rocher hazelnut balls, Nutella chocolate hazelnut spread and popular Baby Ruth, Butterfinger and Crunch candy bars, lists a farming group in a community near the forest as the source of its cocoa supplied by Olam, the Italian company says on its website.

McLean, Virginia-based Mars Inc., one of the world’s largest end users of cocoa with brands from Snickers to M&Ms, Dove, Twix and Milky Way, uses Nigerian cocoa from both Olam and Tulip, according to online company documents.

Ferrero, Mars and Tulip say they’re committed to their anti-deforestation policies, use GPS mapping of farms, and their suppliers are certified through independent standards.

Ferrero also says it relies on satellite monitoring to show that its “cocoa sourcing from Nigeria does not come from protected forest areas.” Mars says its preliminary findings show that none of the farms it’s mapped overlap with the reserve.

Tulip’s managing director, Johan van der Merwe, said in an email that the company’s cocoa bags, which AP photographed in farmers’ warehouses inside the conservation zone, are reused and distributed widely so it’s possible they’re seen across Nigeria. He also said “field operatives” complete digital questionnaires about sourcing with all farmers and suppliers.

On the ground, however, farmers and licensed buying agents who said they supply Tulip told AP that they were not required to complete any questionnaire before their cocoa is purchased.

“Though we know they depend on our cocoa, we don’t directly sell cocoa to the exporters like Olam and Tulip, middlemen do, and there are no questions about deforestation,” said farmer Saheed Arisekola, 43, also a college graduate who said he turned to farming because he could not get a job.

As farmers, brokers and buying agents say cocoa from the conservation area flows into Olam’s export supply, U.S. customs records show a slice of where it might be going.

Olam’s American arm, Olam Americas Inc., received 18,790 bags of Nigerian cocoa shipped by its Nigerian subsidiary, Outspan Nigeria Limited, between March and April 2022, according to trade data from ImportGenius.

Olam and Tulip are both licensed to trade Nigerian cocoa certified by the Rainforest Alliance. However, Olam told AP that its license does not cover the Ijebu area, where it sources the cocoa it sends to Ferrero and is near Omo Forest Reserve. Ferrero says Olam’s sustainability standard in the area is verified by a third-party body.

Farmers who told AP that their cocoa heads to Olam and Tulip said they are not Rainforest Alliance certified. Tulip has only one farm with active certification in Nigeria, the nonprofit’s database shows.

The Rainforest Alliance says it certifies that farms operate with methods that prohibit deforestation and other anti-sustainability practices. It says farmers must provide GPS coordinates and geographic boundaries for their plantations, which are checked against public forest maps and satellite data.

The Rainforest Alliance told AP that Nigeria has “unique forest regulation challenges,” including incomplete or outdated data and maps that can “lead to discrepancies when comparing forest data with real on-ground conditions.”

It said it is working to get updated data from Nigerian authorities and would decertify any farms found to be operating illegally in conservation areas following a review. The organization also says companies it licenses can buy cocoa certified by other agencies or that isn’t certified at all.

Starlink Global and Ideal Limited — the Nigerian cocoa exporter that the farmers and buying agents said they sell to — doesn’t have its own farmland in the reserve, “only suppliers from there,” spokesman Sambo Abubakar told AP.

Starlink does not make sustainable sourcing claims on its website, but it supplies at least one company that does — New York-based General Cocoa Co., U.S. trade data shows.

Between March and April 2023, Starlink shipped 70 containers, each loading 4,000 bags of dried cocoa beans, to General Cocoa, according to ImportGenius trade data.

General Cocoa, which is owned by Paris-headquartered Sucden Group, supplies Mars, according to online company documents.

Jean-Baptiste Lescop, secretary general of Sucden Group, says the company manages risks to forest conservation by sourcing Rainforest Alliance cocoa, mapping farms and using satellite images but that it’s a “continuous process” because most farmers in Nigeria don’t have official land ownership documents.

Sucden investigates reports of problems and is working on a response to AP’s findings about Starlink, Lescop said.

WHERE’S THE ENFORCEMENT?

The conservation zone, which spans about 650 square kilometers (250 square miles), is the only remaining vital rainforest in Nigeria’s southwest, conservation officials say. Such forests help absorb carbon from the atmosphere and are crucial for Nigeria to meet its pledges under the Paris climate agreement.

Besides helping fight climate change, the forest is designated an Important Bird and Biodiversity Area by BirdLife International, with significant populations of at least 75 bird species.

“There are now more than 100 illegal settlements of cocoa farmers, who came from other states because the land here is very fertile,” said Emmanuel Olabode, a conservation manager who supervises the reserve’s rangers in the protected areas. “But after some years, the land becomes unproductive.”

The farmers know this.

“We’ll then find another land somewhere else or go back to our original homes to start new businesses,” said Kaseem Olaniyi, who acknowledges that he farms illegally in the conservation zone after moving in 2014 from a neighboring state.

The government in Ogun state, which owns the forest, said in a statement to AP that the “menace of cocoa farming” in the reserve dates back decades and that “all the illegal farmers were forcefully evicted” in 2007 before they found their way back.

“Arrangements are in the pipeline to engage the services of the Nigerian Police Force and the military to evict them from the Forest Reserve,” the government statement said.

However, Omolola Odutola, spokeswoman for the federally controlled police, said they do not have records of such a plan.

The farmers have been ordered not to start new farms, and those who spoke with AP said they are complying. But forest guards said new farms are sprouting up in remote areas that are difficult to detect.

Rangers — who work for the government’s conservation partner, the nonprofit Nigerian Conservation Foundation — and forest guards who are employed by the state government both told AP that lax government enforcement has made combating cocoa expansion a challenge.

They told AP that previous arrests have done little to stop the farmers from returning and that has led to a sense of futility when they encounter illegal farming.

The state government said it “has never compromised regulations” but acknowledged that farmers are in the forest despite its efforts. Homes and other buildings at farming settlements visited by AP have been marked for removal, including warehouses like that of licensed buying agent Kadet, one of the biggest there.

Farmers’ homes lack running water and toilets, forcing women and children to collect water from narrow streams to use while the men work.

The removals have not taken place because officials make money from the cocoa business in the forest, according to farmers and buying agents, who lament the difficult living conditions, with mud roads filled with holes creating high transportation costs that eat away their already meager profits.

The state government declined to comment about making money from illegal cocoa farming in the forest.

The agents have formed a lobby group that has “rapport with government officials” to ensure farmers remain in the conservation zone despite threats to evict them, said Azeez, the owner of buying agent Bolnif who is also chairman of a committee that monitors risks against cocoa business in the forest.

The European Union, the largest destination of cocoa from West Africa, has enacted a new regulation on deforestation-free products that requires companies selling commodities like cocoa to prove they have not caused deforestation. Big companies must ensure they’re following the rules by the end of 2024.

Experts at the Cocoa Research Institute of Nigeria are launching a “Trace Project” in six southern states — though it doesn’t include Ogun state where Omo Forest Reserve is located — to advance efforts against deforestation in cocoa production and ensure Nigeria’s cocoa is not rejected in Europe.

“From the preliminary data collected, major exporters are implicated in deforestation, and it is their responsibility to ensure compliance with standards,” said Rasheed Adedeji, who leads the institute’s research outreach.

But farmers say they’ll keep finding places to work.

“The world needs cocoa, and the government also gets taxes because the cocoa is exported,” said Olaniyi, one of the farmers.

-AP

Middle-aged man spends millions to

Dr. Dharam Raj Upadhyay: Man

Children, Greatest Victims Of Sudan’s

Breathing The Unbreathable Air

Comprehensive Data Protection Law Critically

Gender Differences In Mental Healthcare